Reliable taxi fleet insurance that meets your needs

- Standard or connected cover for fleets of 3 taxis upwards

- We cover Uber fleets, PCO, public hire or a mix of vehicles

- Do you already have a fleet policy with us?

- Contact support

- Make a claim

Why choose Acorn Taxi Fleet Insurance?

Dynamic pricing

We consider factors such as vehicle type and driver experience to give a no-obligation quote based on your specific taxi fleet profile.

Dedicated support

Our team of fleet taxi insurance agents understand the needs of you business and are there to guide you through every step of the process.

Specialist taxi fleet broker

Wide range of vehicles

Whether you operate a fleet of standard taxis, minicabs, or minibuses, we will find the taxi fleet cover that’s right for you.

Dynamic public and private hire fleet insurance

Ride Hailing

- Meets requirements Uber and Bolt (instadocs ready)

- Cover for a different of vehicle types, up to 9 seaters

- Hybrid/electric vehicles insured

- Claims and convictions considered

Public Hire

- Public hire and black cabs covered up to £70k*

- Public fleet insurance with most driving histories considered

- Mix of vehicles up to 9 seats

- Electric and hybrid vehicles covered

Private Hire

- PCO and Private hire fleets up to £60k*

- MPVs & minibuses 16 seats max

- Most driving histories considered

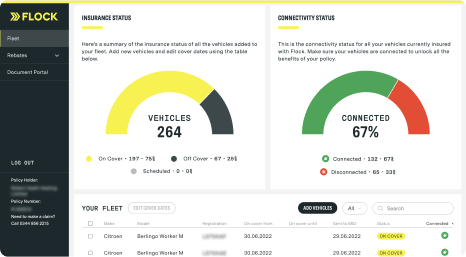

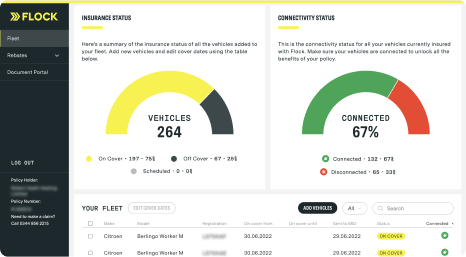

Our connected policies give you complementary access to Flock’s fleet portal

- Add and remove vehicles in a few clicks

- Get insights into safety and status of your claims

- Save with renewal discounts for driving safely

- Do you have more questions?

Which type of cover is right for me?

Claims by third parties up to a max of £2 million

Medical expenses for you and your passengers up to £100 each

Loss or damage to your vehicles caused by fire, lightning,

explosion or theft

Loss or damage to your vehicles after an incident

Windscreen and window repair or replacement

Most popular

![]()

![]()

![]()

![]()

Third Party

Fire and Theft

Third Party Only

Meet the Team

Andreas Lindsay

Head of Retail

Nationwide

Jack Mawdsley

New Business Manager

Nationwide

Dylan Riley

Relationship Manager

Wales and Southwest

Alex Malone

Relationship Manager

London and Southeast

Existing Customers

Manage Your Policy

- Get your documents

- Make changes to your policy

- Manage your payments

- Renew your cover

How to Make a Claim

If you’ve been in an accident our team is available 24/7 to resolve your claim as quickly as possible. Visit our dedicated page to make a claim.

Need Help?

If you have questions about our options or need help with your policy, please browse our FAQs or get in touch. We are here to serve you.

How does taxi fleet insurance work?

Running a taxi business requires keeping your fleet on the road, and it can be a challenging task when renewing individual policies for all the vehicles in your fleet. Taxi fleet insurance simplifies this process. With Acorn’s fleet taxi cover, you only take out one insurance policy for the whole fleet. This policy covers all the taxis in your fleet, saving you the hassle when it comes to renewing your policy.Taxi Insurance Articles & Guides

Mini Fleet Insurance Explained

Attention all business owners and fleet managers! Are you looking for the perfect mini fleet insurance solution? Did you know that the demand for fleet vehicles surged…

What are the Uber Driver Requirements in the UK?

Are you to take advantage of the booming ride share industry? With ride share services experiencing their ninth consecutive…

Creepin’ It Real: Top 10 Halloween Car Accessories for Taxi Drivers in 2024

As the spooky season approaches, private hire taxi drivers have a unique opportunity to transform their rides and delight passengers with fang-tastic...

Uber Drivers: How to Achieve and Maintain Five-Star Ratings

Uber drivers can significantly benefit from having a positive rating. Are you a new Uber driver looking for taxi insurance, or are you already on the road with Uber and hoping…

Frequently asked questions

What is taxi fleet insurance?

Taxi fleet insurance specifically refers to a policy that covers multiple vehicles under one agreement, providing a streamlined approach to insuring all the vehicles in a taxi business.

What are the benefits of taxi fleet insurance?

This insurance helps the management of a taxi fleet by having a single policy for all vehicles used as taxis in a business. Potentially, a policy of this kind can reduce costs, compared to having several individual taxi policies, and offers the convenience of one renewal date.

Does Acorn’s taxi fleet insurance cover any driver?

Policies can be arranged to cover any driver, which offers flexibility for businesses, but there is also the option for named driver cover if preferred. Please note terms and conditions may apply.

Can I insure different types of taxi vehicles under the same policy?

Can I include vehicles used for private hire and public hire in the same policy?

Acorn’s fleet taxi policies are designed to accommodate both private and public hire vehicles within the same fleet. You can also insure vehicles used for rideshare, such as Uber or Bolt.

Are there different payment options available for our fleet insurance for taxis?

We understand the importance of having different payment options available for your taxi business; we can offer:

- Annual payment: Pay your premium in full upfront for the year.

- Short-term options: Choose taxi fleet cover from 7-day, monthly or 6-month cover, if an annual policy isn’t right for you.

- Discuss further options: Contact us to discover if we can help you with your payment options.

How many vehicles does my taxi fleet need to have to apply for Acorn taxi fleet insurance quote?

You must have at least 3 vehicles in your taxi fleet to qualify for a taxi fleet insurance policy with Acorn.

Can I insure minibuses as part of my taxi fleet?

Yes — if you have a minibus, or minibuses, as part of you taxi fleet, they will be considered for coverage within the fleet policy, with a maximum of 16 seats being the acceptable upper limit in terms of size.

Does Acorn offer cover for chauffeurs as part of its taxi fleet policies?

Chauffeur insurance will be considered as part of a taxi fleet insurance policy, but this is dependent on vehicle value and clientele.